|

. . Loan Terms . Term of the Loan . . Interest Rate . %. Initial Payment Date . . Loan Amount $ . . Enable Monthly Prepayments . Starting Date . . Prepayment Amount . $ 1/12 of Monthly Payment. Last Payment . . . . . Enable Annual Prepayments . . Starting Date . . . Amount . $ Full Monthly Payment. . Make . Payments. Make up to 5 One-time Prepayments . . Prepayment Date. Amount. . . $. . . $. . . $ Show

Top 1: Extra Payment Calculator ~ Amortization Schedules ~ Accelerated PaymentsAuthor: mortgage-x.com - 138 Rating

Description: Loan Terms . Term of the Loan Interest Rate . %. Initial Payment Date Loan Amount $ Enable Monthly Prepayments . Starting Date Prepayment Amount . $ 1/12 of Monthly Payment. Last Payment . Enable Annual Prepayments Starting Date . Amount . $ Full Monthly Payment Make . Payments. Make up to 5 One-time Prepayments Prepayment Date. Amount. $. $. $

Matching search results: By making additional monthly payments you will be able to repay your loan much more quickly. The calculator lets you determine monthly mortgage payments, find out how your monthly, yearly, or one-time pre-payments influence the loan term and the interest paid over the life of the loan, and see complete amortization schedules. ...

Top 2: Amortization Schedule with Extra Payments - Mortgage CalculatorAuthor: amortizationschedule.org - 110 Rating

Description: Amortization Schedule with Extra Payments. Loan Amortization Schedule Excel With Extra Payments. What is additional principal payment?. How is an amortization schedule calculated?. How to pay off my mortgage faster with extra payments?. Mistakes to avoid with extra payments. How much can you save with extra payments?. Can lump sum extra payment save money on your mortgage?. Mortgage Calculator With Extra Payments. Loan Calculator Results. Mortgage Amortization Schedule With Extra Payments. Compare Monthly vs. Bi-weekly.

Matching search results: The amount of money that you can save with extra payments depends on a few variables, the interest rate, term, loan balance, number of extra payments, and the size of the extra payments. Let's take a look at the following example. Mortgage Amount: $300,000 Loan Terms: 30 year Interest RatePayoff: 30 Years Interest PaymentTotal PaymentExtra ...

Top 3: Mortgage/Loan Calculator with Amortization Schedule - Bret WhisselAuthor: bretwhissel.net - 119 Rating

Description: Almost any data field on this form may be calculated. Enter the appropriate numbers in each slot, leaving blank (or zero) the value that you wish to determine, and then click "Calculate" to update the page Principal. . Payments per Year Annual Interest Rate Number of Regular Payments Balloon Payment Payment Amount Show Amortization Schedule This loan calculator is written and maintained by Bret Whissel. See Bret's Blog for help, a spreadsheet, derivations,

Matching search results: Loan Amortization Calculator. Almost any data field on this form may be calculated. Enter the appropriate numbers in each slot, leaving blank (or zero) the value that you wish to determine, and then click "Calculate" to update the page. Principal : Payments per Year: Annual Interest Rate: Number of Regular Payments: Balloon Payment: Payment Amount: ...

Top 4: Amortization Schedule Calculator | BankrateAuthor: bankrate.com - 102 Rating

Description: What is amortization?. What is an amortization schedule?. How do you calculate amortization?. How do I calculate monthly mortgage payments?. Next steps in paying off your mortgage. The monthly mortgage payment formula Mortgages Amortization CalculatorAmortization is paying off a debt over time in equal installments. Part of each payment goes toward the loan principal, and part goes toward interest. As the loan amortizes, the amount going toward principal starts out small, and gradually grows

Matching search results: The mortgage amortization schedule shows how much in principal and interest is paid over time. See how those payments break down over your loan term with our amortization calculator. ...

Top 5: What monthly payments are needed to pay off my loan sooner? - CalcXMLAuthor: calcxml.com - 129 Rating

Description: This information may help you analyze your financial needs. It is based on information and assumptions provided by you regarding your goals, expectations and financial situation. The calculations do not infer that the company assumes any fiduciary duties. The calculations provided should not be construed as financial, legal or tax advice. In addition, such information should not be relied upon as the only source of information. This information is supplied from sources we believe to be. reliable

Matching search results: Over the course of a loan amortization you will spend hundreds, thousands, and maybe even hundreds of thousands in interest. ... realize tremendous savings in interest payments. Use our extra payment calculator to determine how much more quickly you may be able to pay off your debt. Loan Information. Original loan balance ($) Annual percentage ... ...

Top 6: Amortization CalculatorAuthor: calculator.net - 78 Rating

Description: Monthly Pay: $1,687.71. What is Amortization?. Paying Off a Loan Over Time Monthly Pay: $1,687.71. Total of 180 Loan Payments. $303,788.46. Total Interest. $103,788.46 While the Amortization Calculator can serve as a basic tool for most, if not all, amortization calculations, there are other calculators available on this website that are more specifically geared for common amortization calculations.What is Amortization?There are two general definitions of amortization. The first is the

Matching search results: An amortization schedule helps indicate the specific amount that will be paid towards each, along with the interest and principal paid to date, and the remaining principal balance after each pay period. Basic amortization schedules do not account for extra payments, but this doesn't mean that borrowers can't pay extra towards their loans. ...

Top 7: Microsoft Excel Mortgage Calculator with Amortization ScheduleAuthor: mortgagecalculator.org - 115 Rating

Description: Want to Calculate Mortgage Payments Offline?. Microsoft Excel Mortgage Calculator Spreadsheet Usage Instructions. Enable Your Worksheet to Calculate Your Loan. Payments. Some of Our Software Innovation Awards!. Current Mortgage Rates. Find Out What You Qualify For. Atlanta Homeowners May Want to Refinance While Rates Are Low How to Calculate Mortgage Payments in Excel With Home Loan Amortization Schedule & Extra Payments Calculator RatesWant to Calculate Mortgage Payments Offline? We have of

Matching search results: Our Excel mortgage calculator spreadsheet offers the following features: works offline; easily savable; allows extra payments to be added monthly; shows total interest paid & a month-by-month amortization schedule ; Microsoft Excel Mortgage Calculator Spreadsheet Usage Instructions. The calculator updates results automatically when you change ... ...

Top 8: Loan Amortization Schedule and Calculator - Vertex42.comAuthor: vertex42.com - 127 Rating

Description: Loan Amortization Schedule - Commercial Version. Amortization. Calculations. Loan Payment Schedule. More Amortization Info. Bonus #1: Home Mortgage Calculator (Commercial Version). Bonus #2: Simple Interest Loan Calculator (Commercial Version). Bonus #3: Interest-Only Loan Calculator (Commercial Version). Bonus #4: BETA - Advanced Loan Payment Schedule. Interest Rate, Compound Period, and Payment Period. Negative Amortization An amortization schedule is a list of payments for a mortgage or loan,

Matching search results: Sep 11, 2020 · Description. This spreadsheet-based calculator creates an amortization schedule for a fixed-rate loan, with optional extra payments.. Start by entering the total loan amount, the annual interest rate, the number of years required to repay the loan, and how frequently the payments must be made. ...

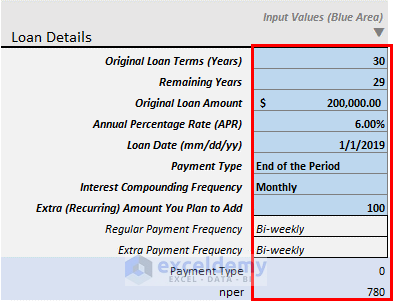

Top 9: Biweekly Mortgage Calculator with Extra Payments in ExcelAuthor: exceldemy.com - 138 Rating

Description: Download Practice Workbook. Biweekly vs. Monthly Mortgage. Calculate Accelerated Biweekly Payment. Advantages of Making Biweekly Payments. Considerations Before Paying Biweekly Mortgage. Step 1: Input Loan Details Do you know just by paying your monthly mortgage bi-weekly, you can save a lot of time and money? When we take and pay a long-term loan (like home mortgages), most of the payments go to pay the interest of the loan. If we can pay a good earlier (at the initial stage of the loan) amoun

Matching search results: Sep 28, 2022 · Biweekly vs. Monthly Mortgage. Bi-weekly is a period of 14 days. If you pay the loan with the bi-weekly schedule, your total number of payments in a year will be 26 (26 x 14 days = 364 days).If you pay with the monthly schedule, you will pay 12 times a year. So, regular bi-weekly is 26 payments per year. But if you plan to pay twice a month, your total payments will … ...

Top 10: Loan Amortization with Extra Principal Payments Using Microsoft …Author: tvmcalcs.com - 151 Rating

Description: Setting Up the Worksheet. Calculating the Interest, Principal, and Full. Payment Amount. Calculating the Remaining Balance. Adding the Extra Principal Payment. About that Last Payment. The Final Amortization Schedule. Finding the Payoff Period. Calculating the Total Interest. Calculating the Total of the Regular Principal. Calculating the Total of the Extra Principal Payments. Calculating. the Total Savings in Interest Are you a student? Did you know that Amazon is offering 6 months of Amazon Pr

Matching search results: Total Interest Paid = Number of Payments x Per Period Payment - Principal Amount. So, we can calculate the original amount of interest that would be paid if no extra payments are made, and we can calculate the interest paid with the extra payments. The difference is the amount saved. Use this formula in E8: =(B3*B5*B6-B2)-(E7-E6) The Final ... ...

Top 11: Extra Payment Mortgage Calculator: Making Additional Home Loan ...Author: mortgagecalculator.org - 146 Rating

Description: Extra Mortgage Payments Calculator. Refi Today & Save: Lock-in Atlanta's Low 30-Year Mortgage Rates Today. Exercising Additional Payment Options. Want to Make Irregular Payments? Do You Need More Advanced Calculation Options?. Early Loan Repayment: A Little Goes a Long Way. Considerations for Extra Payments. Calculating Your Mortgage Overpayment Savings. Atlanta Homeowners May Want to Refinance at Today's Low Rates & Save. Atlanta Homeowners May Want to Refinance at Today's Low Rates & Save Sav

Matching search results: Extra Mortgage Payments Calculator. This calculator allows you to enter an initial lump-sum extra payment along with extra monthly payments which coincide ...Menu · Remaining Principal · Bi-weeklyExtra Mortgage Payments Calculator. This calculator allows you to enter an initial lump-sum extra payment along with extra monthly payments which coincide ...Menu · Remaining Principal · Bi-weekly ...

Top 12: Amortization Schedule Calculator - BankrateAuthor: bankrate.com - 102 Rating

Description: What is amortization?. What is an amortization schedule?. How do you calculate amortization?. How do I calculate monthly mortgage payments?. Next steps in paying off your mortgage. The monthly mortgage payment formula Mortgages Amortization CalculatorAmortization is paying off a debt over time in equal installments. Part of each payment goes toward the loan principal, and part goes toward interest. As the loan amortizes, the amount going toward principal starts out small, and gradually grows

Matching search results: The mortgage amortization schedule shows how much in principal and interest is paid over time. See how those payments break down over your loan term with ...Prepaying your mortgage · What Is Mortgage Amortization? · Mortgage recastingThe mortgage amortization schedule shows how much in principal and interest is paid over time. See how those payments break down over your loan term with ...Prepaying your mortgage · What Is Mortgage Amortization? · Mortgage recasting ...

Top 13: Additional Payment Calculator - Bankrate.comAuthor: bankrate.com - 118 Rating

Description: Use this additional payment calculator to determine the payment or loan amount for different payment frequencies. Make payments weekly, biweekly, semimonthly, monthly, bimonthly, quarterly or annually. Then examine the principal balances by payment, total of all payments made, and total interest paid.

Matching search results: Use this additional payment calculator to determine the payment or loan amount for different payment frequencies. Make payments weekly, biweekly, ...Use this additional payment calculator to determine the payment or loan amount for different payment frequencies. Make payments weekly, biweekly, ... ...

Top 14: Amortization extra payment calculator - U.S. BankAuthor: usbank.com - 141 Rating

Description: Use this amortization calculator to get an estimate of cost savings and more.. What is an amortization schedule?. What is the effect of paying extra principal on your mortgage? Use this amortization calculator to get an estimate of cost savings and more.This amortization extra payment calculator estimates how much you could potentially save on interest and how quickly you may be able to pay off your mortgage loan based on the information you provide. It also makes some assumptions about mortgag

Matching search results: This amortization calculator shows the schedule of paying extra principal on your mortgage over time. See how extra payments break down over your loan term ...This amortization calculator shows the schedule of paying extra principal on your mortgage over time. See how extra payments break down over your loan term ... ...

Top 15: Mortgage Payoff CalculatorAuthor: calculator.net - 84 Rating

Description: If You Know the Remaining Loan Term . Payoff in 15 years and 8 months. If You Don't Know the Remaining Loan Term . Payoff in 14 years and 4 months. Principal and Interest of a Mortgage. Refinance to a shorter term If You Know the Remaining Loan Term Use this calculator if the term length of the remaining loan is known and there is information on the original loan – good for new loans or preexisting loans that have never been supplemented with any external payments.. Original Loan Amount Origina

Matching search results: Free mortgage payoff calculator to evaluate options to pay off a mortgage earlier, such as extra payments, bi-weekly payments, or paying back altogether.Free mortgage payoff calculator to evaluate options to pay off a mortgage earlier, such as extra payments, bi-weekly payments, or paying back altogether. ...

Top 16: Loan Calculator with Extra Payments - MyCalculators.comAuthor: mycalculators.com - 102 Rating

Description: Do this calculation FIRST-as if you're NOT making extra payments. Remember!Paying down the principal on your loan more quickly will not reduce the minimum monthly payment or allow you to skip a payment until the loan is paid in full.Most loans (mortgage and other) in the United States compound interest monthly.Mortgage loans in Canada compound interest semiannually.FYI30 years=360 months25 years=300 months20 years=240 months15. years=180 months10 years=120 months 5 years= 60 months

Matching search results: Monthly Payment Loan Calculator w/Extra Payments · 200000 (or 200,000) = Loan Amount · 360 = Months · 4.25 = Interest Rate (Compounded Monthly) · Press the Payment ...Monthly Payment Loan Calculator w/Extra Payments · 200000 (or 200,000) = Loan Amount · 360 = Months · 4.25 = Interest Rate (Compounded Monthly) · Press the Payment ... ...

Top 17: Mortgage Payoff Calculator | RamseySolutions.comAuthor: ramseysolutions.com - 118 Rating

Description: Mortgage Payoff Calculator Uses . Planning to Pay Off Your Mortgage Early? . Understand Your Mortgage Payment . Accelerate Your Mortgage Payment Plan . Calculate Different Scenarios Mortgage Payoff Calculator Uses With this mortgage payoff calculator, estimate how quickly you can pay off your home. By calculating the impact of extra payments, you can learn how to save money on the total amount of interest you’ll pay over the life of the loan. Planning to Pay Off Your Mortgage Early? Use

Matching search results: Making extra payments toward your principal balance on your mortgage loan can help you save money on interest and pay off your loan faster. If you want to make ...Making extra payments toward your principal balance on your mortgage loan can help you save money on interest and pay off your loan faster. If you want to make ... ...

Top 18: Extra Payment Calculator ~ Amortization Schedules - Mortgage-XAuthor: mortgage-x.com - 124 Rating

Description: Loan Terms . Term of the Loan Interest Rate . %. Initial Payment Date Loan Amount $ Enable Monthly Prepayments . Starting Date Prepayment Amount . $ 1/12 of Monthly Payment. Last Payment . Enable Annual Prepayments Starting Date . Amount . $ Full Monthly Payment Make . Payments. Make up to 5 One-time Prepayments Prepayment Date. Amount. $. $. $

Matching search results: By making additional monthly payments you will be able to repay your loan much more quickly. The calculator lets you determine monthly mortgage payments, ...Initial Payment Date: Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 ...Prepayment Amount: $; 1/12 of Monthly PaymentTerm of the Loan: 50 Years 49 Years 48 Years 47 Years 46 Years 45 Years 44 Years 43 Years 42 Years 41 Years 40 Years 39 Y...Starting Date: Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 1972 1973 1974 1975 1976 1977 1978 1979 1980 1981 1982 ...By making additional monthly payments you will be able to repay your loan much more quickly. The calculator lets you determine monthly mortgage payments, ...Initial Payment Date: Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 ...Prepayment Amount: $; 1/12 of Monthly PaymentTerm of the Loan: 50 Years 49 Years 48 Years 47 Years 46 Years 45 Years 44 Years 43 Years 42 Years 41 Years 40 Years 39 Y...Starting Date: Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 1972 1973 1974 1975 1976 1977 1978 1979 1980 1981 1982 ... ...

Top 19: Mortgage calculator with extra payments | Chase.comAuthor: chase.com - 116 Rating

Description: We’ve signed you out of your account. You’ve successfully signed out We’ve enhanced our platform for chase.com. For a better experience, download the Chase app for your iPhone or Android. Or, go to System Requirements from your laptop or desktop.

Matching search results: Mortgage calculator with extra payments can help you understand how you could save money and payoff your mortgage early by making additional mortgage ...Mortgage calculator with extra payments can help you understand how you could save money and payoff your mortgage early by making additional mortgage ... ...

Top 20: Mortgage Payoff Calculator 2aAuthor: mtgprofessor.com - 87 Rating

Description: Mortgage Payoff Calculator (2a) Extra Monthly Payments Who This Calculator is For: Borrowers who want an amortization schedule, or want to know when their loan will pay off, and how much interest they will save, if they make extra voluntary payments in addition to their required monthly payment. What This Calculator Does:This calculator provides amortization schedules for mortgages, with or without additional payments. If additional payments are made,. interest savings and reduction in length of loan are calculated..

Matching search results: For example, if you want to make an extra monthly payment of $100 during months 1-9, and an extra payment of $400 for months 7-36, you enter $100 for months 1-6 ...Extra Payment Intervals: Amount; of ChangeFor example, if you want to make an extra monthly payment of $100 during months 1-9, and an extra payment of $400 for months 7-36, you enter $100 for months 1-6 ...Extra Payment Intervals: Amount; of Change ...

|

Related Posts

Advertising

LATEST NEWS

Advertising

Populer

Advertising

About

Copyright © 2024 ketiadaan Inc.